Get Connected

Subscribe to our e-newsetter and get the latest information delivered straight to your inbox.

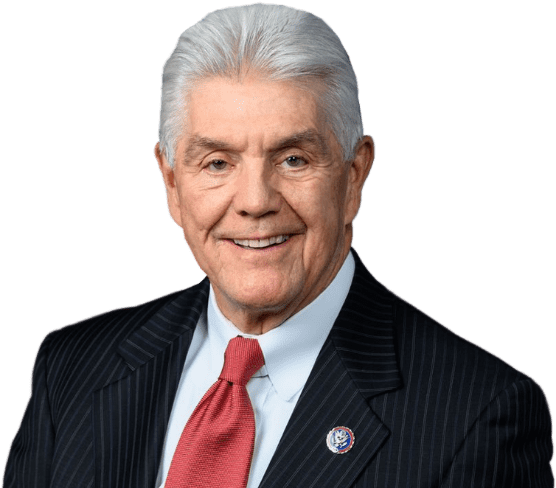

MEET THE CHAIRMAN

Roger Williams represents the 25th congressional district of Texas which is located in North Texas and stretches from Tarrant County in the east to Callahan County in the west. Williams was raised in the Fort Worth area and attended Texas Christian University, where he was (...)

LEARN MORE